As a follow-up on an earlier post of mine about SPACs, I’m sharing some information from a recent deck by AGC, one of the leading SPAC bankers.

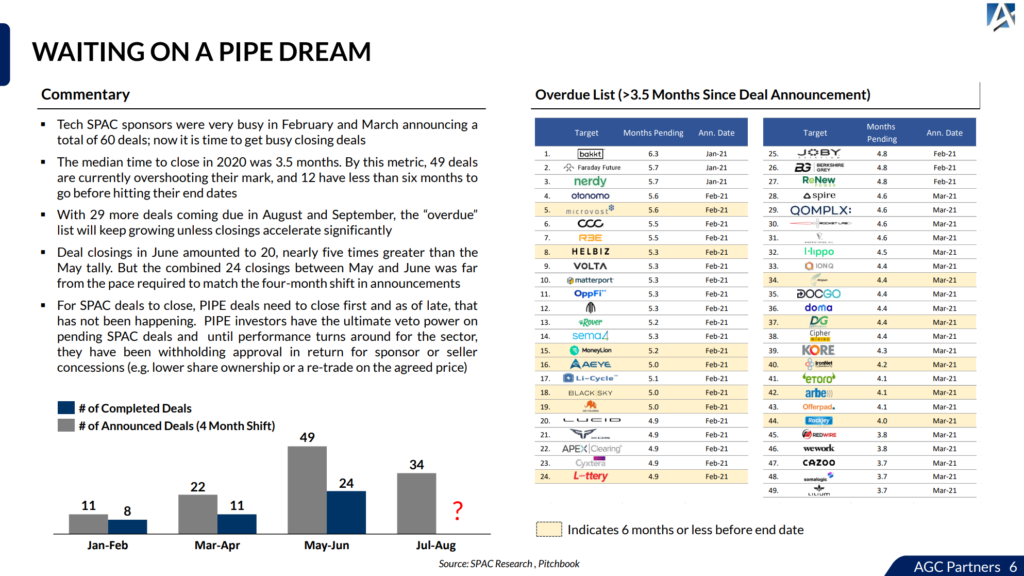

AGC breaks down the current SPAC failures into several categories:

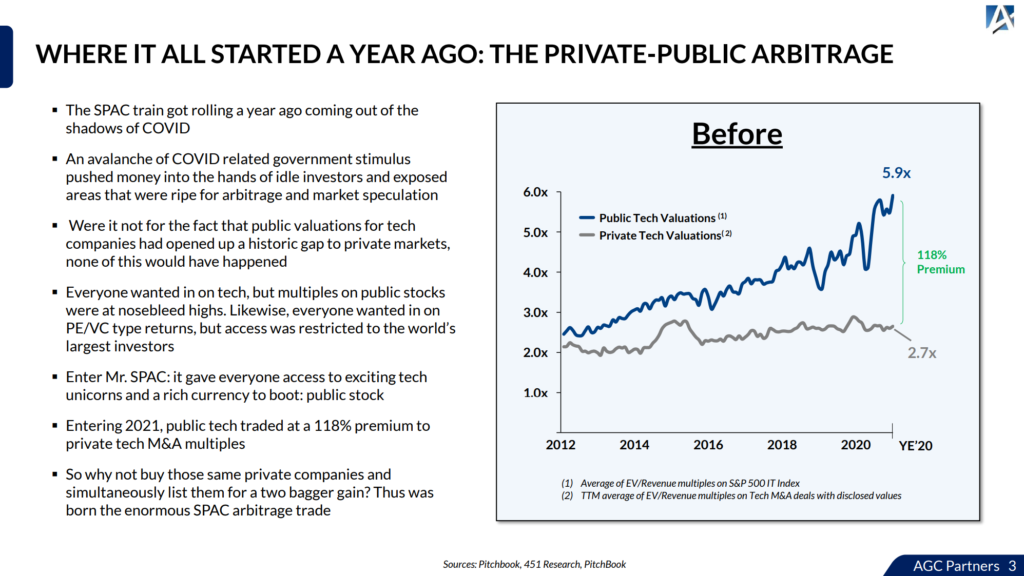

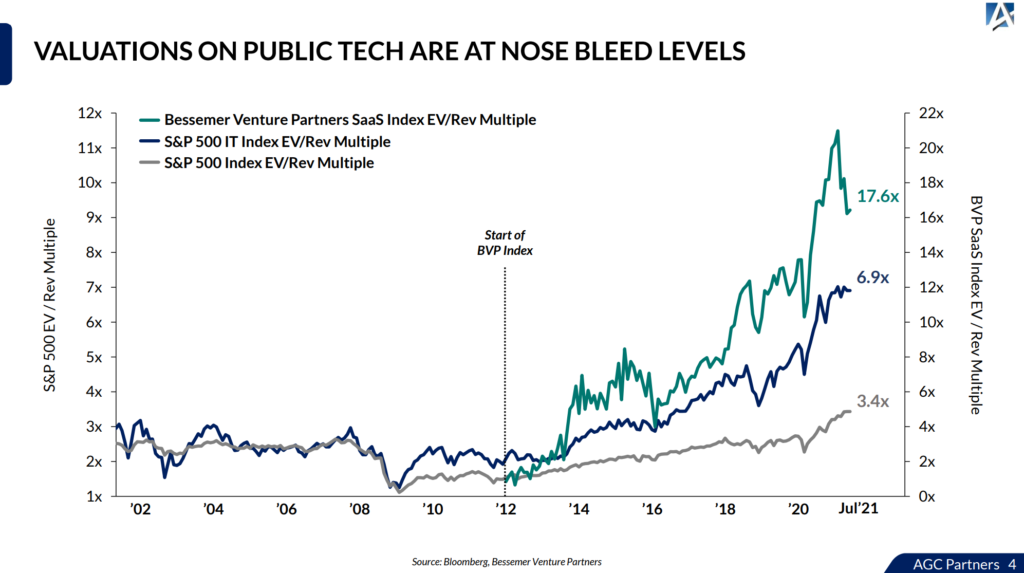

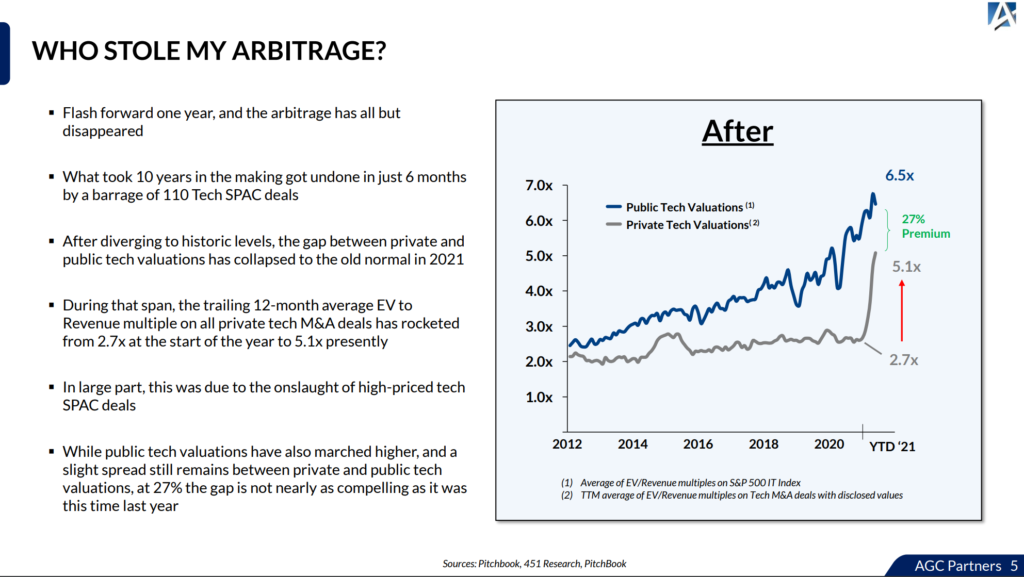

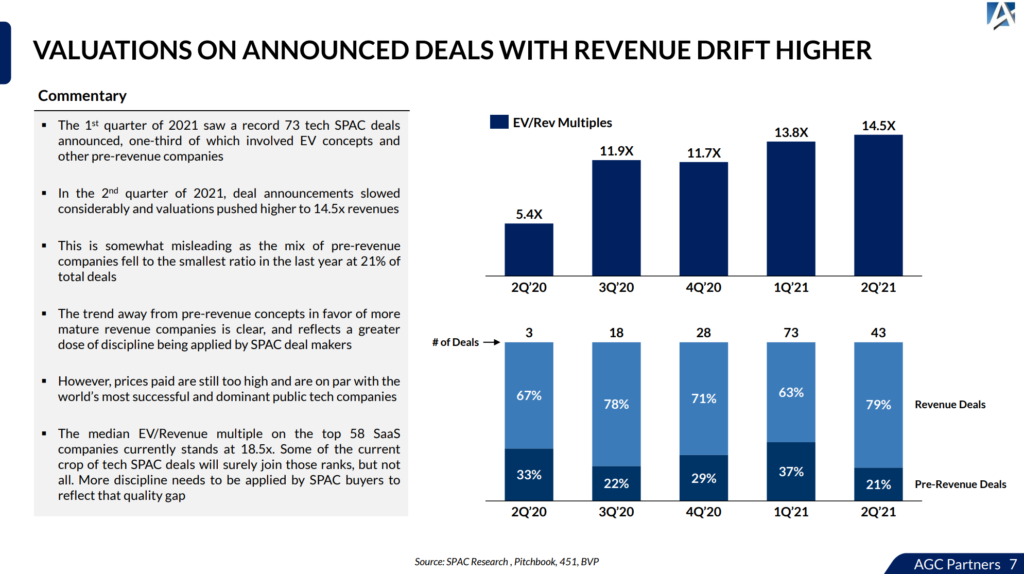

- High quality private companies do not want to sell at a discount, particularly to an unproven SPAC which may require six months to close. This has caused prices for SPAC acquisitions to rise from mid-single digit multiples on revenue in the first half of 2020 to over 14x revenues in 2Q 2021. As AGC says: “All the juice is being squeezed out of these private companies in the drive to get a deal done.”

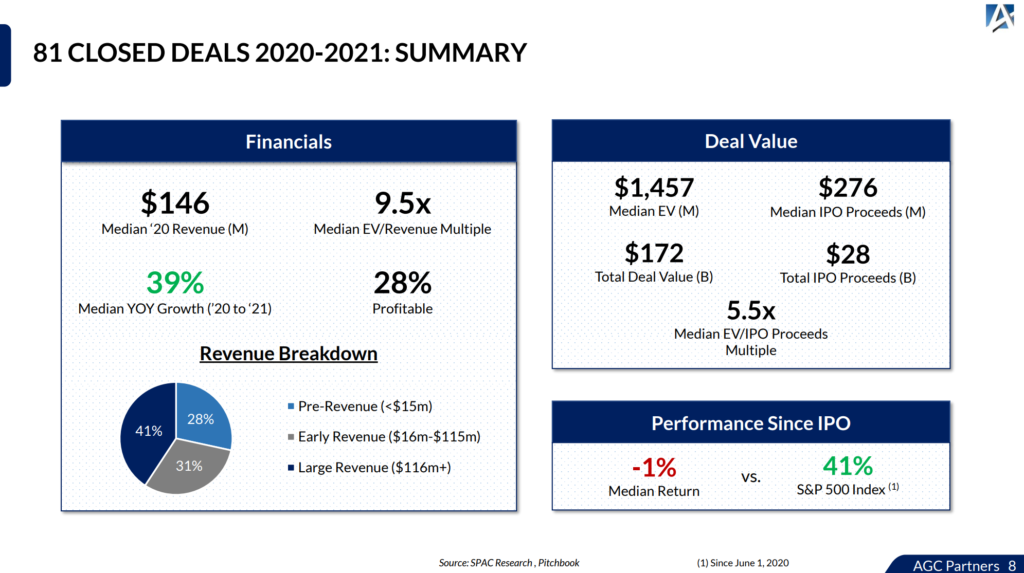

- Poor performance: Median return to IPO investors on the 81 completed SPACs in 2020 and 2021 is -1%, woefully underperforming the markets.

- Many (but not all) of the completed SPACs are pre-revenue concept plays or second tier companies that could not go public in a traditional IPO.

- Sponsor incentives are still too far out of line with other stakeholders’ for creating long term value.

Some selected slides from their latest presentation:

The full report is here.