I’ve been following with some interest the arguments that billionaires are somehow massively skirting the tax system.

While I’m certainly in favor of tax equality as much as the next person, it appears that some of the breathless reporting is based on a confusion of facts — and a misunderstanding of some basic economics.

In the US, it’s hard to avoid paying taxes, even if you’re a vastly wealthy person. There are schemes, and I’ve seen a few, but they are dodgy and won’t last.

If a rich person earns income through a paycheck (“earned income”), that rich person will pay, just like everyone else, at the top-end of the tax bracket.

But, like virtually every other developed country in the world, we have a different formula for taxes for unearned income (namely, money one makes from things like stocks, bonds, real estate, etc.), especially gains made on investments that have been held for more than a year.

Capital gains, a form of unearned income, occurs when one realizes a gain on an investment. And, like most developed countries, our tax rate for those holding into an investment for more than a year is low – 20%.

However, the key word is “realizes” – which means selling a stock or a house. This is where the billionaires all have to pay the piper.

Now, there are ways to lower ones tax burden – but they are complicated and not the subject of this blog.

A gain is only a gain when it’s realized – i.e. sold

Remember back in the 90s, when people had millions in stock in dot com companies? A few years later, that paper wealth evaporated. And if they hadn’t sell the stock, they were screwed. They didn’t realize the gain — it was unrealized.

The error: conflating unrealized gains with income

Those arguing for wealth equity are making some fundamental errors, by confusing unearned income with earned income, and then compounding the error by adding unrealized capital gains.

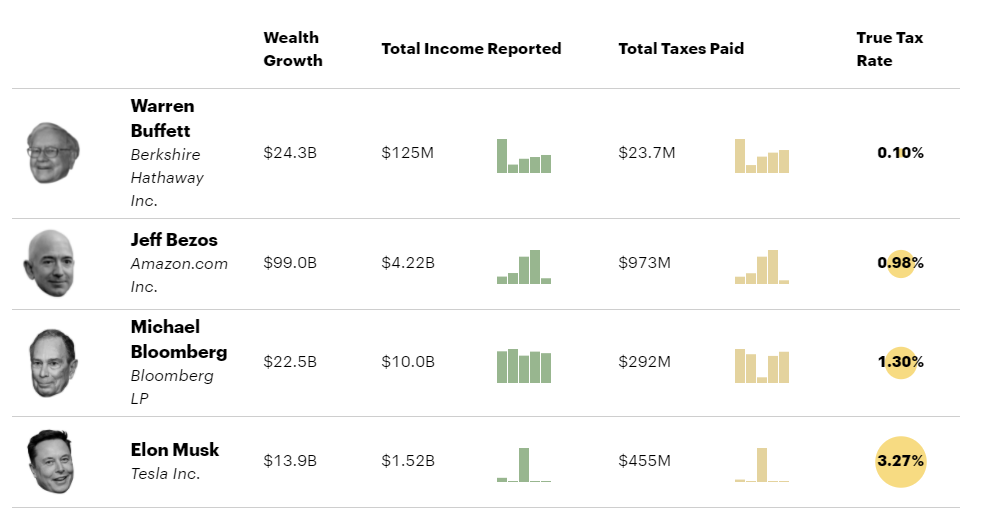

In other words, look at this chart from the explosive ProPublica piece:

The chart is extraordinarily misleading. Warren Buffet has $24.3 billion in “wealth growth” – but that’s largely in unrealized stock in Berkshire Hathaway. He had, in fact, income of $125 million, and paid taxers of nearly $24 million – a tax rate of about 19%. Ellon Musk, the supposed “bad boy”, actually paid 29% tax on his $1.52 billion in income.

The fact that Tesla stock is through the roof is meaningless. Because it’s paper wealth, and guess what – the stock is down and Elon’s paper wealth is actually lower. That’s why taxing paper wealth is meaningless, and no developed country in the world does so.

The Roth IRA issue

Another issue is around Roth IRAs, which are certainly ripe for fixing. But blaming Peter Thiel, for example, for amassing $5 billion in his Roth IRA is meaningless. Fix the IRA. Don’t kill Peter Thiel.

Traditional IRAs have been around for a long time, and allowed one to put money in on a pre-tax basis, and then defer paying taxes until retirement.

In 1997, in the “Taxpayer Relief Act”, the Roth IRA was introduced, which allowed people to put money in on a post-tax basis. In other words, after one had paid taxes on the income.

Two years later, Peter Thiel was starting PayPal and put PayPal stock into the Roth. The value was low, but then PayPal was a new company, a private company. The idea that he “lied” about the value is senseless – those valuations were determined by standard valuation mechanisms. Those mechanisms were inherently imperfect, and that’s why in 2005, the 409a mechanism was introduced. Nevertheless, private company stock is always undervalued, as it is illiquid and private.

In other words, what if Thiel had transferred shares from pets.com? Or any of the other thousands of huge dot com failures? We wouldn’t care.

Thiel had no idea that PayPal would be worth billions: He transferred PayPal stock into an IRA at the value at the time. Then, PayPal later went public and then got sold to eBay, making Thiel a massive profit – in his Roth IRA. After that, he used Roth IRA money to invest in more, growing it significantly.

It’s a problem with the Roth IRA mechanism, so let’s fix the IRA, not fix Peter Thiel, who was being a rational actor and acting well within the rules and the law at the time. Perhaps now, with the 409a valuation system, we would also have a fairer system, but 409as can themselves be problematic.

We can (and must) fix the Roth, by disallowing the types of contributions made by Thiel and others. We can fix this, as it is flawed. But some of the invective I’ve heard against Thiel is unwarranted. He did nothing wrong in the context of the time.

Equity in taxation

Peter Thiel, Warren Buffer, Elon Musk – these are very rich men. But they’re not fat cats who have sat around smoking from a hukkah pipe in a haram. They’re visionaries who have done an enormous amount for the common good. Without Musk, it’s arguable we wouldn’t have the electric car resolution, doing far more to combat global warming than most mandates. Thiel reinvented economics with PayPal, and did many other great things. And Buffet – well, we can thank him primarily for being interesting, but also saving us a ton on car insurance through GEICO.

Let’s get equity in taxation. A national sales tax replacing income tax, for example, would make much more sense, as when those billionaires (good or evil) go out and buy a new Ferrari, they would be forced to pay tax.

Income tax is inherently problematical as a tax collection mechanism: it punishes production, creates ample opportunity for loopholes and special-interests (mortgage interest deduction, for example) while creating enormous privacy issues (and why isn’t anyone screaming about confidential tax returns being stolen from the IRS?).

We can come up with better tax schemes that are not regressive, but create wealth and opportunity for everyone.