The Jobs Act has done good things to jump-start funding.

Title II, already in place, has led to a dramatic increase in crowdfunding. However, only accredited investors (i.e. rich people) can invest.

Title IV (popularly known as Reg A+), set to take place in a couple of months, opens the field to non-accredited investors (i.e. everyone else). This is what people are talking about. (There is no Title III. While Title III significantly broadens the field for startups to raise capital, it is still not finalized.)

Among some breathless enthusiasm for Title IV are some facts that aren’t broadly understood by both investors and startups.

To explain, there are two levels to Title IV:

- Tier 1 allows companies to raise up to $20 million.

- Title 2 allows companies to raise up to $50 million.

Tier 1 companies do not need audited financials. However, they will still need to file their offerings in every state where the securities are offered. This could cost startups tens of thousands of dollars in legal and compliance fees (if you’ve ever been through this process, you’ll know it’s really not a big deal, but it just costs money for lawyers to file the paperwork).

Tier 2 companies don’t have to register with each state, but will have the requirement to have audited financials. Now, this is where it gets tough: audited financials for a startups are about as rare as a brass monkey’s bottom. And if they do get audited financials, it is quite expensive. (In a side story, two states have filed lawsuits against the SEC over the state exemption. They want some control over the process.)

For startups, this is tough, which means the primary beneficiaries will be companies that can actually afford these fees or have audited financials. And those companies, of course, may be just what the SEC wanted in the first place: to protect the grandmothers and orphans who may lose their money in these investments (putting aside the fact that there is actually a cap on how much a non-accredited person can invest anyway, no more than 10% of their income/net worth on a deal).

So, I don’t see the funding world changing overnight with this change, although I do think that we will see some impact.

However, another side of me can’t help but worry that we have opened a pandora’s box with all of these new investment vehicles. In fact, I’m actually glad that the SEC is being so cautious. They, like me, are quite concerned about creating a funding bubble. But that horse may have already left the proverbial barn door (pardon the mixing of metaphors).

As a veteran blogger, I admit I was impressed with this overview of how Canva increased their traffic by 226%. Solid block and tackling backed by analytics and a bit of ingenuity.

As a veteran blogger, I admit I was impressed with this overview of how Canva increased their traffic by 226%. Solid block and tackling backed by analytics and a bit of ingenuity.

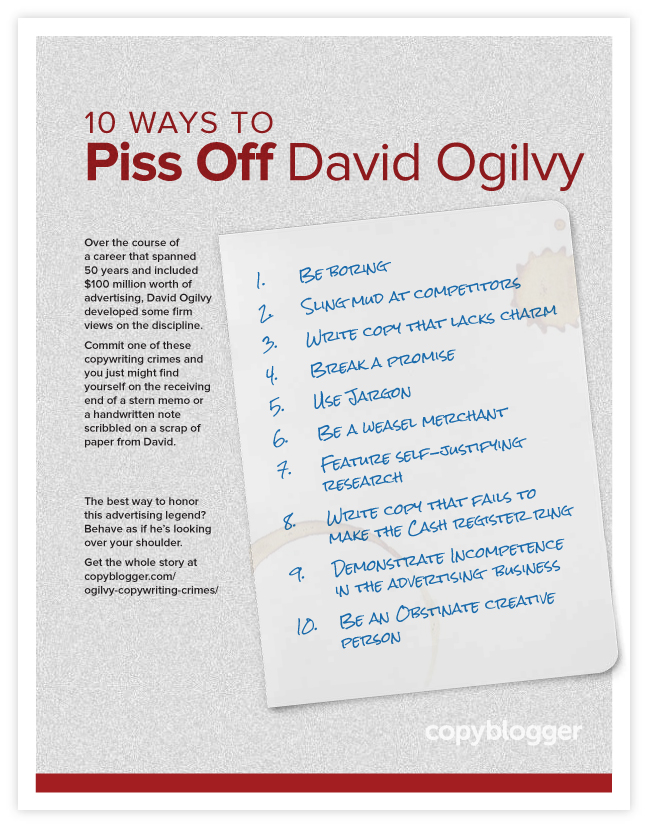

Warms my heart, this

Warms my heart, this